Forex Blog |

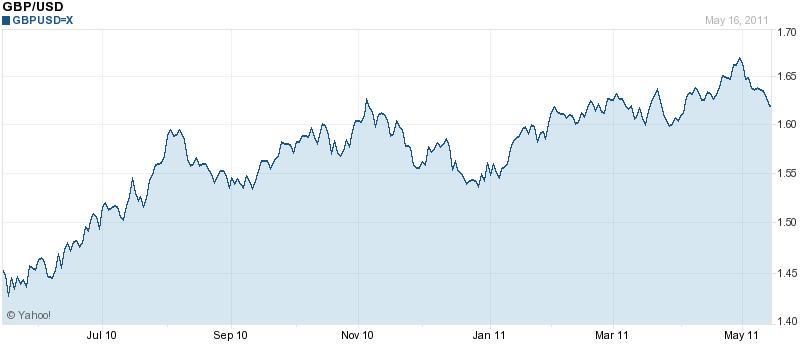

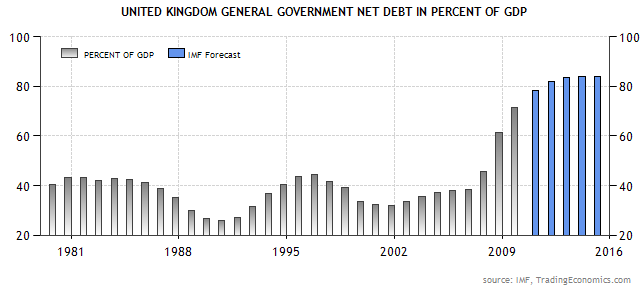

| Pound Correction is Already Underway Posted: 17 May 2011 12:32 AM PDT Last week, I was preparing to write a post about how the British pound was overvalued and due for a correction, but was sidetracked by a series of interviews (the second of which – with Caxton FX – incidentally also hinted at this notion). Alas, the markets beat me to the bunch, and the pound has since fallen more than 3% against the dollar- the sharpest decline in more than six months. Moreover, I think there is a distinct possibility that the pound will continue to fall. Not much has changed since the last time I wrote about the pound. If anything, the fundamentals have deteriorated. Fortunately, the latest GDP data showed that the UK avoided recession in the latest quarter, but this is offset by the fact that overall GDP remains the same as six months ago and still 4% below pre-recession levels. Despite a slight kick from the royal wedding in April, the UK will almost certainly finish 2011 towards the low end of OECD countries, perhaps above only Japan. Ed Balls, shadow chancellor of the UK, has conceded, “We’ve gone from the top end of the economic growth league table to being stuck at the bottom just above Greece and Portugal.” Of course, the question on the minds of traders is whether the Bank of England (BOE) will raise interest rates. Initially, it was presumed (by me as well) that the BOE would be the first G4 central bank to hike, if only to contain high inflation. In fact, at the March monetary policy meeting, three members (out of nine) voted to do just that. However, there stance softened at the April meeting, and they have since been beaten to the bunch by the European Central Bank (ECB) which is notoriously more hawkish. Now, it seems reasonable to wonder whether the BOE might also fall behind the Fed. While still high (4%), the British CPI rate has slowed in recent months. “The bank's Governor Mervyn King said on Jan. 26 that rising prices would be temporary.” Moderating commodity prices have reduced the need for a rate hike, and bolstered the case for keeping the pound week. Unemployment is high, construction spending is falling, and the current account deficit remains wide. Moreover, budget cuts (declined to contain a national debt that has almost doubled in the last three years) and a a hike in the VAT rate have dampened the economy further, to the point that it might not be able to withstand even a slight rate hike.

It seems that the only thing that kept the pound afloat so long was its correlation with the euro, which recently rose above $1.50. It has since fallen dramatically and dragged the pound down with it. In fact, the pound probably needs to fall another 3% just to stay on track with the euro. If this correlation were to break down, it would almost certainly fall much further. It has become cliched to suggest that the forex markets have become a reverse beauty pageant, whereby investors vote not on the most attractive currencies, but rather on the least ugly. At this point, it is safe to say that among G4 currencies, the pound is the ugliest.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment