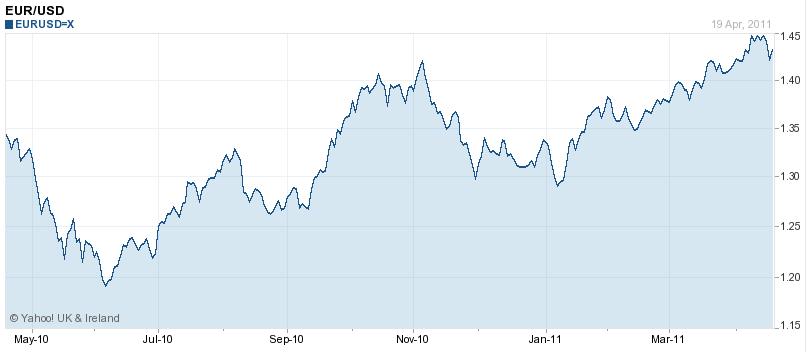

|  |  |  | | | | | Forex Blog | | | | | | | | |  |  |  | | | | | | | | Over the last three months, the Euro has appreciated 10% against the Dollar and by smaller margins against a handful of other currencies. Over the last twelve months, that figure is closer to 20%. That’s in spite of anemic Eurozone GDP growth, serious fiscal issues, the increasing likelihood of one or more sovereign debt defaults, and a current account deficit to boot. In short, I think it might be time to short the Euro.

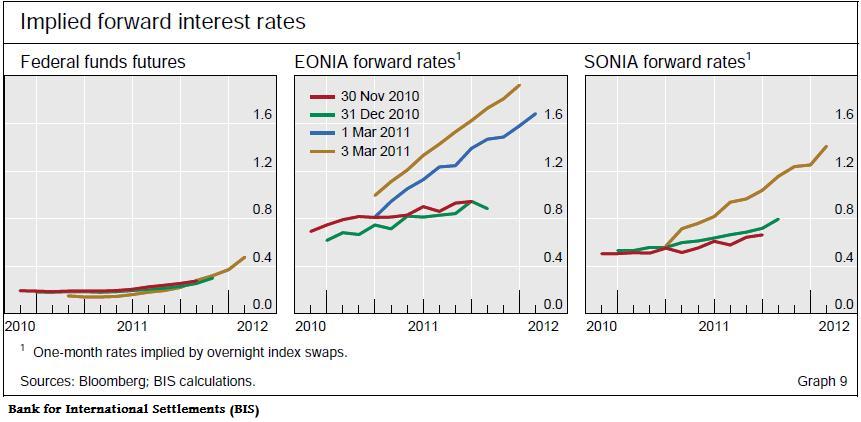

There’s very little mystery as to why the Euro is appreciating. In two words: interest rates. Last week, the European Central Bank (ECB) became the first G4 Central Bank to hike its benchmark interest rate. Moreover, it’s expected to raise rates by an additional 100 basis points over the next twelve months. Given that the Bank of England, Bank of Japan, and US Federal Reserve Bank have yet unwind their respective quantitative easing programs, it’s no wonder that futures markets have priced in a healthy interest rate advantage into the Euro well into 2012.

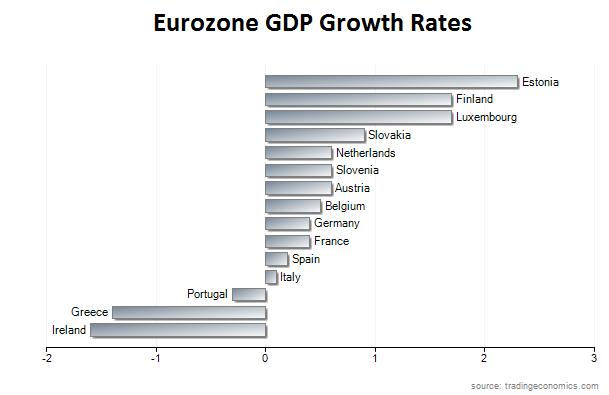

From where I’m sitting, ECB rate hike was fundamentally illogical, and perhaps even counterproductive. Granted, the ECB was created to ensure price stability, and its mandate is less nuanced its counterparts, which are charged also with facilitating employment and GDP growth. Even from this perspective, however, it looks like the ECB jumped the gun. Inflation in the EU is a moderate 2.7%, which is among the lowest in the world. Other Central Banks have taken note of rising inflation, but only the ECB feels compelled enough to preemptively address it. In addition, GDP growth is a paltry .3% across the EU, and is in fact negative in Greece, Ireland, and Portugal. As if the rate hike wasn’t bad enough, all three countries must contend with a hike in their already stratospheric borrowing costs, ironically making default more likely. Talk about not seeing the forest for the trees!

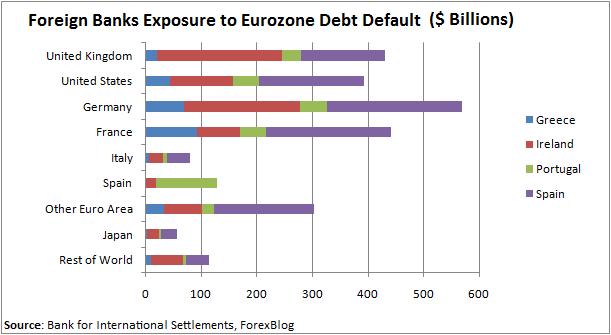

If the rumors are true, Portugal will soon become the third country to receive a bailout from the EU. (It should be noted that as recently as November, Portugal insisted that it was just fine and that a bailout wasn’t necessary). Its sovereign credit rating is now three notches above junk status. Today, Greece became the first Eurozone country to be awarded this dubious distinction, and Ireland is now only one downgrade away from suffering the same fate. Of course, Spain insists that it is just fine and denies the possibility of a bailout. At this point, though, does it have any credibility? Based on rising credit default swap rates (which serve as a gauge of the probability of default), I think that investors have become a little more cynical about taking governments at face value. I have discussed the fiscal woes of the Eurozone in previous posts, and don’t want to dwell on them here. For now, I’d only like to add a footnote on the extent to which their problems are intertwined. Banks in Germany and France (as well as the rest of the EU) have tremendous balance sheet exposure to PIGS’ sovereign debt, which means that any default would multiply across the Eurozone in the form of bank failures. (You can see from the chart below that the exposure of the US is small, relative to GDP).

Some analysts insist that all of this has already been priced into the Euro. Citigroup Said, “The market is treating many of these [sovereign credit rating] downgrades as rearguard actions which are already well discounted.” Personally, I don’t think that forex markets have made a sincere effort to grapple with the possibility of default, which appears increasingly inevitable. In fact, when S&P issued a warning on the US AAA rating, traders responded by handing the Euro its worst intraday decline in 2011. Anyway you cut it, I think the Euro is overvalued. Regardless of what the ECB is doing, market interest rates don’t really confer much benefit from holding Euros. Even if the rate differential widens to 1-2% over the next year (which is certainly not guaranteed, as Jean-Claude Trichet himself has conceded!) this isn’t really enough to compensate for the possibility of default or other risk event. Regardless of whether you want to be long or short risk, there isn’t much to be gained at the moment from holding the Euro.  | | | | | | | | | | | | | | |  |  |  | | | | | | | | During recent interviews with the Forex Blog, both Mike Kulej of FX Madness and the team at Action Forex imparted their beliefs that the New Zealand Dollar is currently the world’s most undervalued currency. Since I hadn’t written about the Kiwi in a few months, I decide to some research, ad came to a slightly different conclusion. In keeping with the spirit of debate, I’d like to defend the opposite premise- that the New Zealand Dollar is now one of the world’s most overvalued currencies.

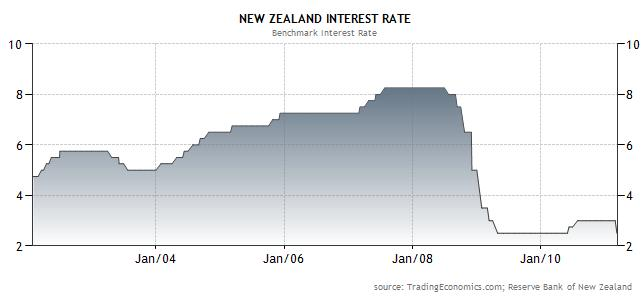

There are two principal reasons for the Kiwi’s perennial appeal with forex traders. First, New Zealand frequently boasts some of the highest interest rates in the industrialized world. Before the credit bubble burst, New Zealand’s benchmark interest rate was a whopping 8.25%. Moreover, because of its association with Australia, investors are quick to ascribe to it (dubiously) a greater sense of security than they would to emerging market economies with similarly high interest rates. For example, while Brazilian rates are usually higher, the markets less apt to lump the Real together with the Australian Dollar, even though it’s arguably a closer fit than the Kiwi.  While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher. While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher.

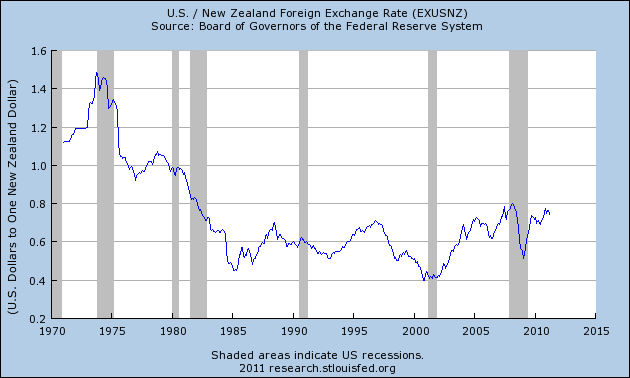

Thus, it is continually one of the most popular target currencies for carry trades. The extent of this phenomenon is such that turnover in the Kiwi is 100x greater than its GDP would imply. As I pointed out in an earlier post, this is the highest ratio of any currency in the world. In fact, “Dr Alan Bollard, Governor of the Reserve Bank [of New Zealand], once described it as an international standard of value that just happens to be used by a small country as its money.” The credit crisis should have shattered the myth of the NZD as a stable currency, since the NZD lost 50% of its value in a matter of months. In addition, the benchmark rate has been lowered to 2.5%, a record low. When you take inflation into account, the rate is -2%, which as far as I know, is among the lowest in the world. When you factor in consecutive budget deficits for the first time in two decades and the (unrelated) explosion in public debt, it baffles me that yield seekers would still be interested in holding the Kiwi.

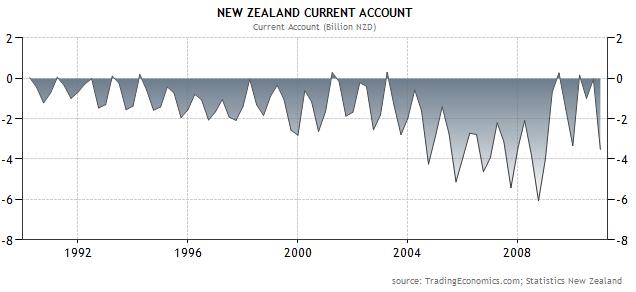

The other source of strength is the perception that the Kiwi is a commodity currency. To be fair, the production and export of agricultural products (dairy, meat, wool, etc.) makes a significant contribution to New Zealand’s economy. In addition, the prices for such agricultural staples have been rising faster than prices for imported goods, to the extent that the terms of trade have widened further in New Zealand’s favor. Unfortunately, this is ultimately irrelevant, since the aggregate balance of trade is currently in deficit, where it has stood for most of the last decade. If prices for energy and traditional commodities continues to rise, the current account deficit would at risk for eclipsing the record 6% set in 2008.

With all of this in mind, it’s tough to understand how the New Zealand Dollar could be closing in on a post-float (30 year) high against the Dollar, last set in 2008. The New Zealand Dollar has recovered most of its post-credit crisis losses, despite a lack of fundamental support. Its recovery has even outpaced the rise in the New Zealand stock market. In short, I’m inclined to agree with TD Securities: ” ‘If ever there was a dangerous time to enter a NZD carry trade this is it: the NZD is increasingly stretched, with the risk-reward now squarely being the NZD declining from here’…if the NZD breaches prior record highs, ‘it could be an attractive time to trim some net longs.’ ”

| | | | | | | | |  |  |  |  |  |  |

0 comments:

Post a Comment